74% of drivers say they will drive five minutes out of their way to go to a c-store they prefer.

Despite rising price sensitivity at the pump, both consumers and convenience retailers agree that drivers are willing to go out of their way to visit the c-store they prefer instead of shop for the lowest price, according to the results of two new surveys released by NACS.

The 2022 NACS Consumer Fuels Survey found that 74% of drivers say they will drive five minutes out of their way to go to the store they prefer, contrasted with 64% who say they would drive five minutes out of their way to save five cents per gallon.

Similarly, the Q2 2022 NACS Pulse Survey found that 75% of convenience retailers believe consumers would drive five minutes out of their way to go to the store they prefer, while 67% say consumers would drive five minutes out of their way to save five cents per gallon.

Both surveys show a clear pattern: Preference beats price.

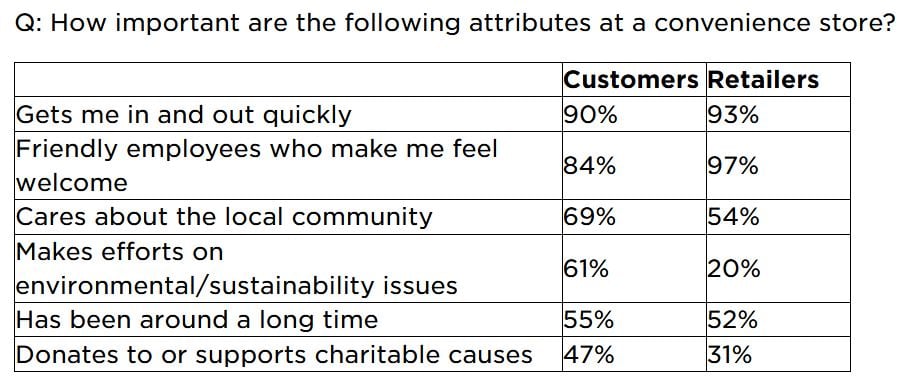

The retailer and consumer surveys also found similarities for the top reasons customers select a place to shop: speed of service, friendly customer service and care for their community.

“These findings show that customers value the importance of stories about how you matter in their lives—and that’s certainly a positive story that convenience stores can and do tell,” said Jeff Lenard, NACS vice president of strategic industry initiatives.

For new technologies and innovations, consumers say they are interested in self-checkout (72%), followed by paying via app (59%) and checkout-free technology (57%). Meanwhile, there are two trends from the pandemic that are of less interest to consumers: delivery (52%) and curbside pickup at convenience stores (50%).

Convenience retailers are building self-checkout capabilities. One in 11 retailers (9%) say they either have or will have self-checkout in place by the end of this year, and nearly 1 in 3 retailers (29%) say they will have self-checkout in their stores by the end of 2023.

“The numbers show that retailers and their customers are aligned, though we need to closely watch how rising gas prices affect business in the long term—90% of consumers say they noticed gas prices have increased, the highest of all categories surveyed, including groceries, vehicle purchases and real estate or rent,” said Lenard.

The Q2 2022 NACS Pulse Survey was conducted in March by NACS Research. A total of 66 retailer member companies representing 2,037 stores participated in the survey. NACS Research conducts quarterly custom research with retailer members to identify key priorities and opportunities across the convenience and fuel retail landscape.

The 2022 NACS Consumer Fuels Survey was conducted February 17-21 by national public opinion research firm Core Decision Analytics (CODA). The survey was conducted among N=1,209 American adults, including n=1,090 who say they drive and fill up at least monthly.

More findings from the survey will be in the April 2022 NACS Magazine cover story, “Choosing Convenience: How the Pandemic Changed Fueling.”