It is undeniable that the Covid pandemic caused online shopping to grow faster than previously predicted. A recently released Morning Consult, Most Trusted Brands 2021 report puts that into perspective. In The Current State of Consumer Trust, the report reveals that prior to the pandemic 69% of US adults shopped mostly in person with 13% mostly shopping on-line. Post-pandemic, consumers say that their on-line shopping nearly doubled to 24%. The US Department of Commerce reports that e-commerce made up 13.6 % of sales in the first quarter of 2021, a 39.1% shift over the same period in 2020.

In Bricks We Trust

Interestingly, the report states that even with the substantial shift in purchasing, there does not appear to be a deterioration in trust among consumers over the course of the past 18 months. However, roughly one third of the customers reported that they do not trust retailers solely with online presence. Retailers with physical storefronts command more trust than online pure plays, moreover retailers with both an online and offline presence are the most trusted by U.S. consumers. Yet more ratification of the importance of omnichannel.

The task of any great and enduring brand is providing a balance of both value and trust. Shoppers are willing to buy more, pay more and even be more forgiving of the brands they trust. The Morning Consult report further states “90% of consumers say their usage of a brand would be harmed if they lost their trust in it. And trust has become a currency that a brand cannot live without.”

Demographers and social scientists are telling us that trust in the way a company operates and what they stand for is becoming every bit as important as what they sell. This confluence of changing demographics, and the “under the microscope” sensibility of a brand’s “true north” is leading to the creation of ESG (Environmental, Social, and Governance) directors in the C-suites of corporations, both retail and otherwise.

It is reasonable to predict that as life on our planet continues to be under threat due to climate change, todays and tomorrow’s consumers will expect more transparency and accountability by the producers, suppliers, and sellers of, well everything.

Coming Home

Among the top 20 most trusted brands outlined in Morning Consult’s “Why Brand Trust Matters”, three of the top five played unique roles in our coming home, and pretty much staying there from April of 2020, through this Summer. Home Depot HD -0.9% placed #1, Lowe’s LOW -1.3% placed #3, and Ace Hardware placed #5. All three were seen as essential players in our attempts to refit our dwellings, to become a combination of home, office, school, entertainment, and fitness centers.

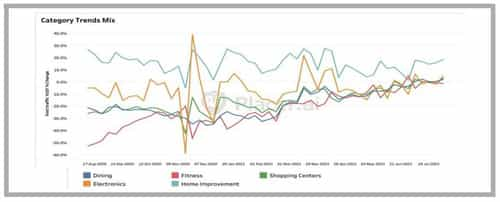

According to Placer.ai, foot traffic for nationwide home improvement stores throughout 66 of the 67-week period from April 13, 2020, through August 1, 2021, showed positive year-over-year traffic against 2019 stats. Most recently, from July 5th through August 1st home improvement store foot traffic averaged 16.4 % above comparable 2019 numbers. This demonstrates a category resilience, which even exceeded that of groceries.

Omni Thinking

It is worth noting that these trusted home improvement retailers made significant omnichannel investments prior to the pandemic. Those efforts positioned them for buy-online-pickup-instore (BOPIS) as well as endless aisle, enabling their consumers to access a broad selection of products not featured in-store.

What cannot be overstated is the degree to which fierce competition between HD and Lowe’s has forced both to constantly up their games. And while the home improvement category remains highly fragmented, according to the Bank of America Home Depot BAC +1.4% and Lowe’s combine to represent 30% of the industry pie; with HD at 17% and Lowe’s taking 12% market share.

Bank of America estimated home improvement sales reached $767 billion in 2020, and trending tailwinds remain. A recent millennial survey found that 72% of the participants said they are likely to purchase a home in the next two years. Given the Millennial’s propensity to spend with companies that have sustainability as a core value, these retailers (along with all others) will remain under the microscope as to what they sell, how they sell it, and how they turn profits into meaningful community and societal contributions.

Ace Still Has Its Place

Let’s not forget Ace Hardware, #5 in the top 20 of most trusted brands. According to J.D. Power’s 2021 Customer Satisfaction Ratings, in the Home Improvement category, Ace Hardware ranked highest for the 14th time in 15 years. Ace scored 863 points (up from 844 in 2020), Lowe’s scored 824 points and Home Depot scored 819. And as I suggested in a past article entitled “Improving Home Improvement”, with over 5,000 stores across the U.S., Ace Hardware has more front doors than both Home Depot and Lowe’s combined.

So not only are most of their locations closer to home, at one-tenth the size of their behemoth brethren, they are infinitely easier to shop as well. The pandemic also emphasized the importance of supporting local businesses. Given that most Ace Hardware’s are locally owned, many customers already had personal connections with their friends at Ace. And while general trending suggests future strength in the entire home improvement category, it’s possible that Ace has found an even more enduring place in the hearts and minds of its customers.